Solana’s Road to ETF Approval: Key Factors

The discussion about which altcoin might next secure exchange-traded funds (ETFs) approval has intensified. Among the candidates, Solana (SOL) stands out, given its significant market presence and strong following.

Solana, the fifth largest cryptocurrency with a market cap exceeding $66 billion, is often referred to as an “Ethereum killer.” This reputation, along with its popularity, makes it a prime candidate for ETF approval. However, achieving this approval involves overcoming significant obstacles.

Hurdles for Solana’s ETF Approval

A primary challenge for Solana is the absence of a regulated futures contract market. Unlike Bitcoin and Ethereum, which have futures products listed on major US exchanges such as CME and CBOE, Solana has not achieved this milestone.

Rumors in late May suggested that the Chicago Mercantile Exchange (CME) declined to list a Solana futures fund. According to Bloomberg ETF analyst James Seyffart, this lack of a regulated futures market is a substantial barrier that could take years to overcome.

“Based on current precedent/needs it will happen within a few years of getting a CFTC regulated futures market. But congress and market structure bills like FIT21 could make it happen quicker,” Seyffart noted.

Another significant hurdle is approval from the Commodity Futures Trading Commission (CFTC), which oversees futures markets.

Moreover, in its lawsuits against Coinbase and Kraken, the US Securities and Exchange Commission (SEC) classified Solana as a security. This classification presents a major obstacle to obtaining ETF approval, as neither Bitcoin nor Ethereum are designated as securities by the SEC.

Industry Experts Remain Skeptical

Several industry experts are skeptical about the likelihood of Solana and other cryptocurrency ETFs.

For instance, Nikolaos Panigirtzoglou, JPMorgan’s managing director and global market strategist, expressed doubts about the approval of Solana ETFs, citing the SEC’s unclear stance on the status of various crypto assets.

“We doubt. The decision by the SEC to approve ETH ETFs is already stretched given the ambiguity about whether Ethereum should be classified as security or not. We don’t think the SEC would go even further by approving Solana or other token ETFs given the SEC has stronger (relative to Ethereum) opinion that tokens outside bitcoin and Ethereum should be classified as securities,” Panigirtzoglou said.

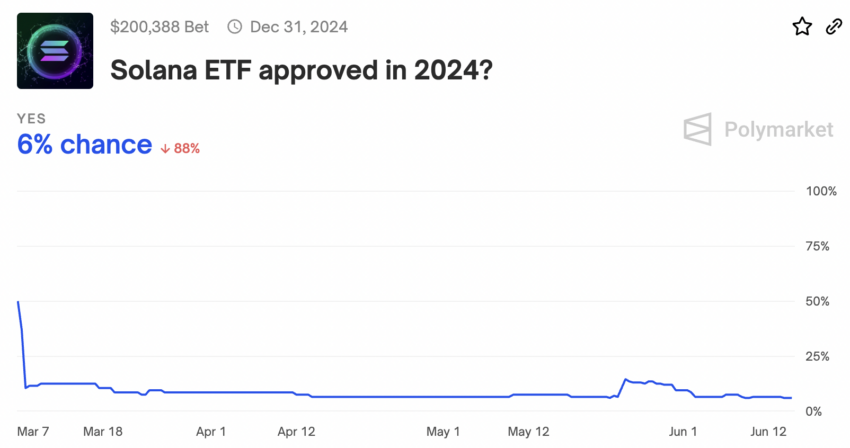

Betting on Polymarket, on the other hand, predicts only a 6% chance that the SEC will approve a Solana ETF by the end of 2024. Meanwhile, no major US firms have formally pursued Solana ETF approval with the SEC.

Current Solana-based financial products in the US include the GrayScale Solana Trust and 21Shares’ Solana Staking ETP (ASOL), which is listed on European stock exchanges.

“I think that Solana is going to outperform Ethereum moving forward. So far, I think that has been true, but I don’t hear any talk of a Solana ETF in the US,” Anthony Pompliano, an investor at Pomp Investments, said.

While the approval of Bitcoin and Ethereum ETFs has fueled speculation about a Solana-based ETF, significant regulatory challenges remain. Nonetheless, the Solana community remains hopeful for a favorable outcome in the near future.

The post Solana’s Road to ETF Approval: Key Factors appeared first on BeInCrypto.