Solana (SOL) Funding Rate Signals A Decline: Investors Expect $130

Solana is now trading around a critical support level after experiencing a 15% decline from its local highs at $162.36. While Solana has shown relative strength compared to other altcoins, the recent price action has introduced heightened volatility and potential risks for investors.

Fear and uncertainty currently dominate the market, with key data from Coinglass revealing a bearish sentiment among traders. This sentiment shift reflects the broader market concerns as Solana approaches this crucial support level.

The coming days will be pivotal in determining whether Solana can stabilize or face additional downside pressure. Notably, some top investors are waiting for a decline to the $130 area, a shy 7% drop from current prices, as a potential entry point.

Given the current market environment, traders and investors are closely monitoring Solana’s performance at this level to gauge its next move. If Solana holds its ground, it could indicate resilience and potential for recovery; however, a failure to maintain this support could lead to further declines.

Solana’s Funding Rate Turns Negative

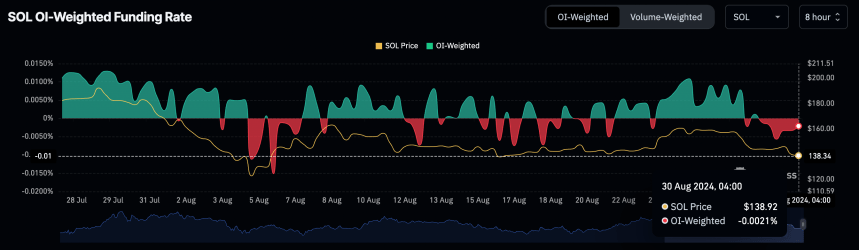

Solana’s recent decline has turned traders bearish, at least in the short term. Crucial data from Coinglass reveals that the funding rate for SOL has turned negative for the first time since August 23.

A negative funding rate indicates that short positions now outweigh long positions, meaning traders are paying to maintain their short bets against SOL. This shift in sentiment suggests that traders are increasingly expecting further declines in Solana’s price.

Adding to the bearish sentiment, several traders and analysts are anticipating a drop towards key support levels. Top trader AlienOvich on X shared an analysis suggesting that Solana could fall further, targeting the $135-$128 area.

If Solana fails to hold its current levels, this bearish scenario could materialize, bringing Solana closer to AlienOvich’s predicted range. Such a decline would not only validate the bearish sentiment currently driving the market but also challenge Solana’s ability to maintain its recent gains.

The next few days will be crucial for Solana as it tests these lower levels. Traders will be closely watching to see if Solana can find support or if the negative sentiment will push the price down further. As the market reacts to this pressure, Solana’s ability to recover and potentially bounce back will be key to determining its short-term trajectory.

Solana Price Action

Solana (SOL) is currently trading at $139.87, significantly below its daily 200 moving average (MA) of $152.28, and is now testing the daily 200 exponential moving average (EMA) after briefly dipping below it. The primary distinction between these two indicators is that an EMA is a weighted average, giving more importance to recent data points, while an MA treats all data points equally.

For SOL to hold this critical support level, it needs to reclaim the EMA and consolidate around the $140 mark. Failing to do so could lead to a further decline toward the lows seen on August 5.

This price level is crucial for determining whether SOL can maintain its current uptrend or if it will continue to face downward pressure. Traders are closely watching this level, as losing it might indicate a deeper correction is imminent.

Cover image from Dall-E, Charts from Tradingview