Lawmakers Set to Challenge SEC’s Aggressive Crypto Enforcement at Hearing

The US House Subcommittee on Digital Assets, Financial Technology, and Inclusion announced a hearing titled “Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets.”

This hearing, set for September 18, is expected to dissect the Securities and Exchange Commission’s (SEC) enforcement agenda under Chair Gary Gensler.

Regulatory Confusion or Enforcement Overreach? Industry Leaders Will Weigh In

According to the latest memorandum, the hearing will feature several key witnesses from both digital assets and regulatory sectors. Former SEC Commissioner Dan Gallagher, now the Chief Legal Officer at Robinhood Markets, will be one of the primary figures testifying. Gallagher has been an outspoken critic of the SEC’s current strategy, advocating for clearer regulatory frameworks.

Joining Gallagher will be Michael Liftik, a former senior adviser and acting enforcement chief at the SEC who is now a partner at Quinn Emanuel Urquhart & Sullivan LLP. Teddy Fusaro, the President of Bitwise Asset Management, will also provide testimony. He is expected to discuss how the SEC’s actions have impacted crypto firms and asset managers in particular.

Additionally, testimony will come from Lee Reiners, a lecturing fellow at Duke University, and Jennifer Schulp, the Director of Financial Regulation Studies at the Center for Monetary and Financial Alternatives.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The hearing is the latest pushback from lawmakers against the SEC. They argue that its current approach under Gary Gensler has stifled innovation in the digital asset sector.

Moreover, these lawmakers claim Gensler has focused on enforcement rather than providing clear regulatory guidelines. Such a stance leaves the crypto industry uncertain about how to operate within the legal framework.

Since taking office as SEC Chair, Gensler has aggressively targeted crypto assets, classifying most tokens as securities under US law. Gensler maintains that most cryptocurrencies fall under the Howey Test’s definition of securities.

The Howey Test is a decades-old framework used to determine what qualifies as a security. It has been at the center of the SEC’s regulatory efforts. Its application has triggered numerous enforcement actions against major crypto firms, sparking widespread frustration.

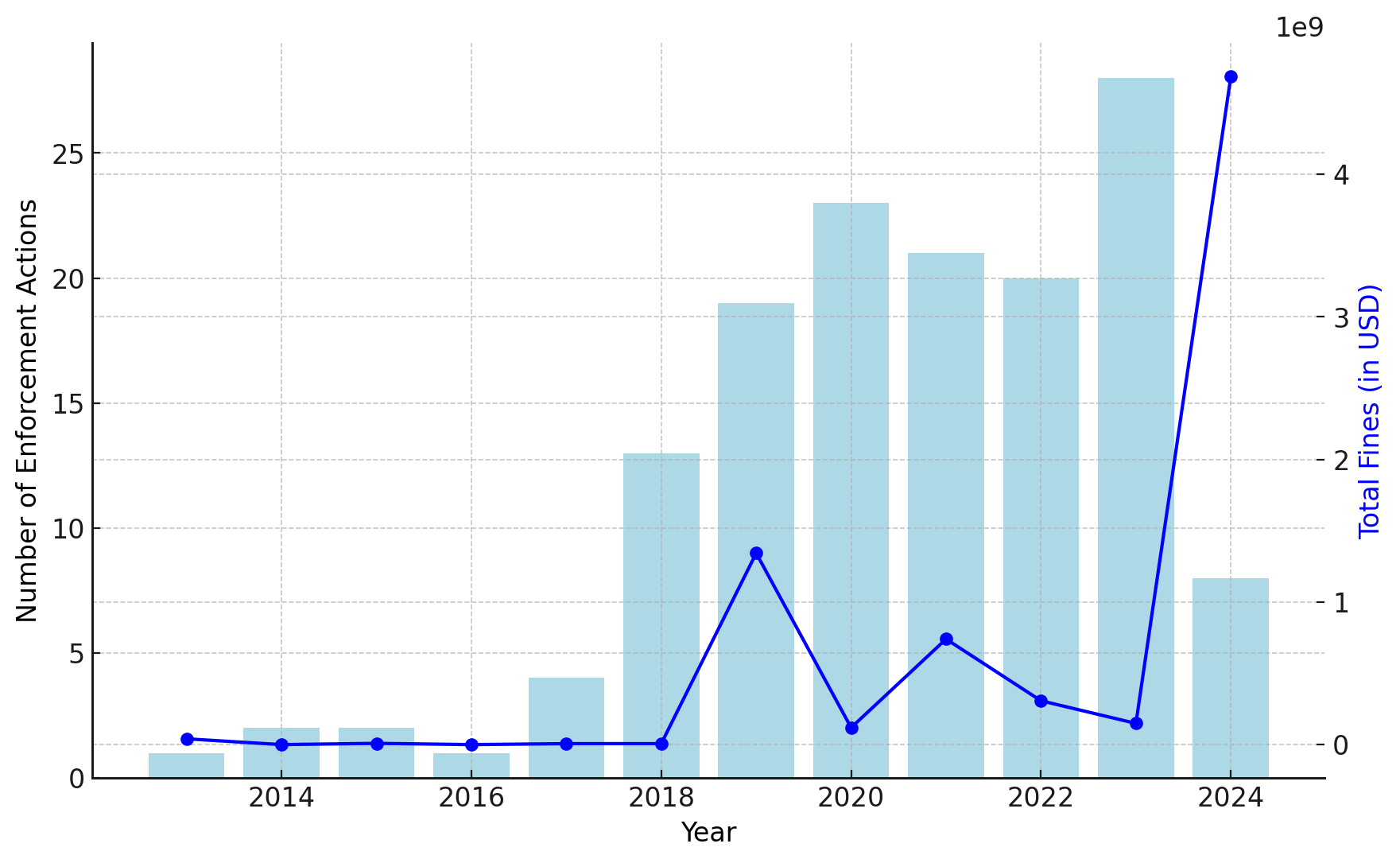

BeInCrypto reported that as of September 10, the commission had imposed $4.68 billion in fines in cases against crypto firms and their executives in 2024. This record amount represents a 3,018% increase compared to penalties collected in 2023.

Hence, critics argue that his enforcement-driven approach stifles innovation and pushes businesses out of the US. For instance, SEC Commissioner Hester Peirce has challenged Gensler’s interpretation, calling for clearer guidance instead of relying solely on enforcement.

“Commissioner Peirce has frequently emphasized her concerns with the SEC’s enforcement-centric approach and highlighted guiding principles for regulating the digital asset ecosystem. Commissioner Uyeda has echoed this sentiment, maintaining, ‘for too long, the Commission’s approach to crypto asset regulation has been to use enforcement actions to introduce novel legal and regulatory theories.’,” the memorandum reads.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

The SEC’s enforcement also extends to other digital assets like non-fungible tokens (NFTs). BeInCrypto reported that OpenSea, a leading NFT marketplace, recently received a Wells notice from the SEC. Similarly, in 2023, the SEC’s action against Stoner Cats, an NFT project tied to an animated series, resulted in a $1 million settlement for selling what the SEC deemed unregistered securities.

The post Lawmakers Set to Challenge SEC’s Aggressive Crypto Enforcement at Hearing appeared first on BeInCrypto.