Gold Prices Sink Below $2,300 Today

Gold prices continue its negative streak this week and have dipped below the $2,300 mark today on Thursday’s opening bell. The prolonged agony for the precious metal is yet to end as the U.S. Treasury yields peaked this month.

Also Read: 93% Oppose U.S. Plans of Creating ‘Asian NATO’

A stronger Treasury return is making gold prices remain on a slippery slope today. The XAU/USD index, which tracks the performance of the precious metal shows it falling to the $2,297 level. Gold prices are down by nearly 0.32 points during today’s opening bell and shed 0.01% of its value.

After Today’s Dip, What Next For Gold Prices?

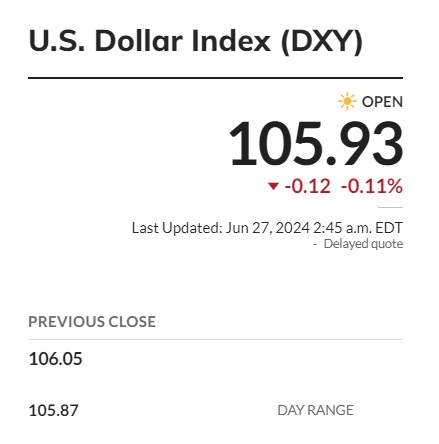

Today’s dip below the $2,300 mark has gold investors worried about further dip in prices. The U.S. dollar is gaining strength in the global market and has touched the 105.91 level today. The world’s leading currency is dominating the forex markets making local currencies dip to new lows.

Also Read: BRICS De-Dollarization Agenda Fails: US Dollar Supremacy Intact

A stronger U.S. dollar has negative effects on gold making the precious metal dip today. If the U.S. dollar gains further in the DXY charts, gold prices are forecasted to fall to the $2,277 level. The prices need to face resistance around these levels and failing to do so could make it fall to the $2,250 range.

Also Read: BRICS Outperforms the US: Becomes Top Exporter of Copper

Therefore, the next few weeks play a crucial role in gold’s performance as it has more chances of a downside. Gold prices are facing correction after rising by nearly 18% year-to-date. Retail investors and institutional investors are mostly indulging in profit bookings and the sell-off is also a reason why gold is dipping today.

The third quarter of 2024 could be challenging for gold prices as volatility lay ahead. Timing the market at this point could be risky as the next direction depends on other macroeconomic factors. It is advised to wait and watch for development before taking an entry position in gold currently.