Ethereum’s Explosion To $3,800 Puts 90% Investors In Profit: Data

On-chain data shows 90% of all Ethereum investors are now in profit following the sharp surge that the asset’s price has seen beyond $3,800.

Ethereum Investors Overwhelming In The Green After ETF Rally

According to data from the market intelligence platform IntoTheBlock, ETH’s latest rally has meant that a shift in investor profitability has occurred on the network.

To keep track of holder profitability, the analytics firm makes use of on-chain data to find what the average acquisition price or cost basis of each address on the blockchain is.

If this price is less than the current spot value of the cryptocurrency for any address, then that particular investor is considered to be in profit, or “in the money”, as IntoTheBlock defines.

On the other hand, the cost basis being lower than the asset’s price suggests the address is holding some net amount of loss, so its holder would be “out of the money.”

Naturally, if the average buying price of the wallet is equal to the spot price of the coin, then the investor would be considered to be just breaking even (“at the money”).

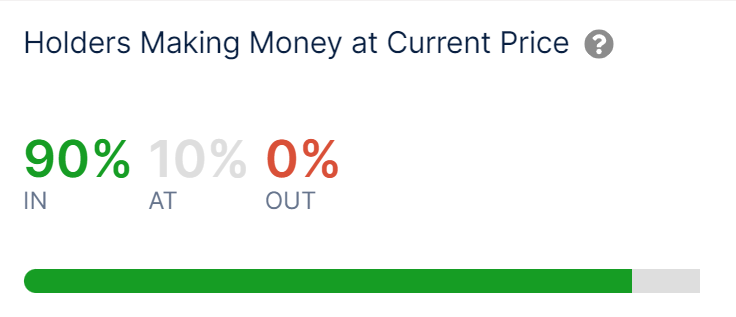

Now, here is what the profitability breakdown of the Ethereum userbase looks like following the sharp rally that the asset has enjoyed:

As is visible above, 90% of the total addresses on the Ethereum network are holding their coins at some net unrealized gain following the sharp surge the asset’s price has seen.

Interestingly, 0% of the wallets are also out of the money, meaning there is no one on the blockchain that’s in losses anymore. 10% of the investors are still on break-even, though.

Historically, holders in profit have been more likely to sell than those in loss. As such, whenever the market has seen a large imbalance towards green investors, the chances of a selloff happening have been notable.

Because of this reason, tops in the cryptocurrency’s price can become more probable at high profitability ratio levels. Since an overwhelming amount of ETH investors are carrying gains now, a mass profit-taking event may be likely to occur, which can impede the current rally.

It should be noted, though, that during bull markets, the asset has generally been able to sustain high investor profits for a while, as high demand keeps flowing in to absorb any profit-taking, before a top eventually occurs.

That said, the likelihood of at least temporary cooldowns taking place can go up if profitability remains high for too long. It now remains to be seen how the Ethereum price develops from here on out and whether the hype around the spot ETFs will be able to counteract any selloffs in the market.

ETH Price

With a rally of over 22% over the past 24 hours, Ethereum has managed to reach the highest levels in more than two months as its price is now trading around $3,800.