Ethereum Price Risks Of Falling To $3.4K Despite ETF Optimism, Here’s Why

Despite the recent regulatory nod for the Spot Ethereum ETF by the U.S. Securities and Exchange Commission (SEC), Ethereum’s price has dipped. Notably, the recent drop in price reflects that the investors are taking a cautious approach before putting their bets. However, amid this, a prominent crypto analyst has outlined several factors that could influence Ethereum’s performance in the coming days, predicting a potential dip to around $3.4K.

Analyst Unveils Potential ETH Movements

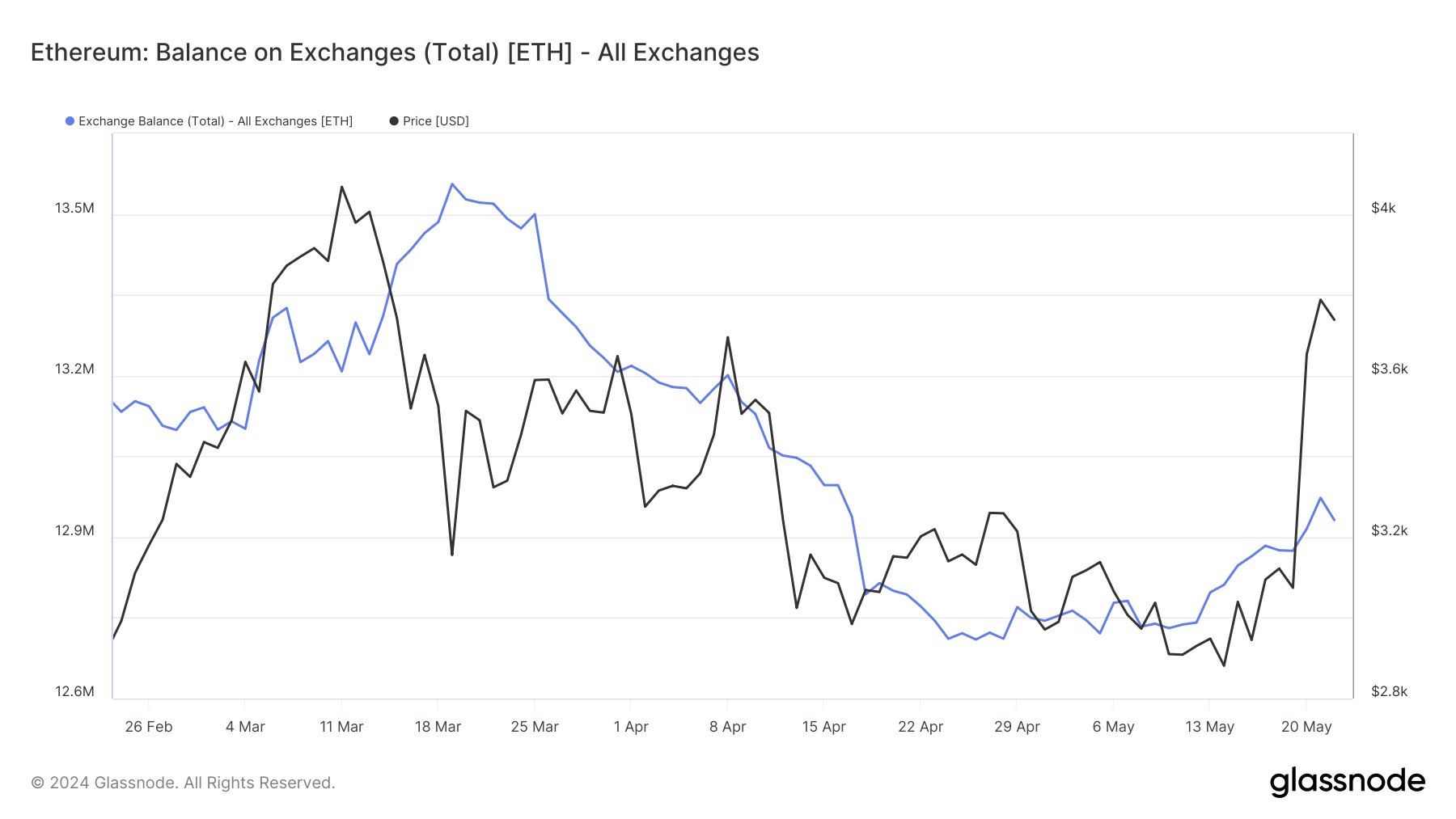

Prominent crypto market expert, Ali Martinez, recently examined Ethereum’s market movements and provided some insights. He noted that substantial transfers of ETH to exchanges are raising eyebrows. This activity has spurred speculation about potential profit-taking, portfolio rebalancing, or mere market speculation.

Besides, adding to the concern, Ethereum co-founder Jeffrey Wilke recently transferred 10,000 ETH, worth approximately $37.38 million, to the Kraken exchange. This significant transfer could indicate a potential sell-off, which might trigger price volatility.

According to Spot On Chain data, Wilke’s move is part of a broader trend where over 242,000 ETH have been transferred to exchange wallets in the past two weeks. Notably, it also adds to the spike in Ethereum trading activity in recent days.

Meanwhile, Martinez also pointed out that the TD Sequential indicator is flashing a sell signal on Ethereum’s daily chart. This indicator, known for predicting market trends, suggests that ETH might face selling pressure. He said that the green nine candlestick on the daily chart could lead to a price retracement or even a new downward phase before any potential uptrend resumes.

Also Read: Ethereum-beta Ondo Finance (ONDO) Price Touches New All-Time High, What’s Cooking?

Key Ethereum Price Levels

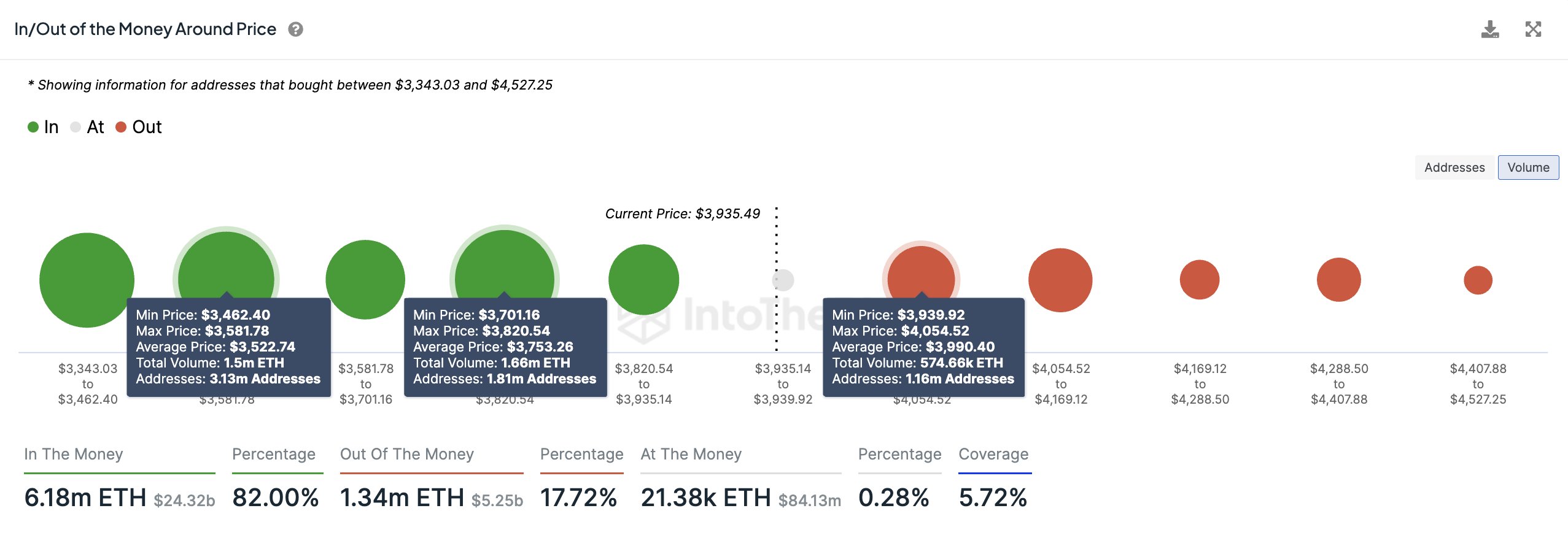

According to IntoTheBlock data, a significant number of Ethereum addresses could provide crucial support if the price dips further. Around 1.81 million addresses bought about 1.66 million ETH between $3,820 and $3,700.

The analyst suggests that this range could act as a buffer against increasing selling pressure. However, if Ethereum’s price falls below this zone, the next support level lies between $3,580 and $3,462. Notably, in this range, 3.13 million addresses were acquired over 1.50 million ETH.

On the other hand, the critical resistance barrier for Ethereum stands between $3,940 and $4,054. More than 1.16 million addresses previously purchased around 574,660 ETH in this range. If Ethereum can surpass this resistance and close above $4,170, it could invalidate the bearish outlook and potentially initiate a new upward trend toward $5,000.

Meanwhile, according to market experts, the Ether ETF could propel an Ethereum price rally in the long run, as seen in the Bitcoin performance after the U.S. Spot Bitcoin ETF approval. However, despite this, the pundits have warned about potential volatility in the short-term, where several investors might book profit given the recent surge in ETH price.

As of writing, Ethereum price slipped about 4.5% and exchanged hands at $3,659.16, with its trading volume soaring 93.23% to $47.91 billion. Over the last 30 days, the second-largest crypto by market cap saw a high of $3,943.55 and a low of $2,815.92. Notably, the Ethereum Open Interest slumped 5.90% to $15.33 billion amid the price dip, CoinGlass data showed.

Also Read: Dogecoin Community Mourns As Iconic Dog ‘Kabosu’ Passes Away At 17

The post Ethereum Price Risks Of Falling To $3.4K Despite ETF Optimism, Here’s Why appeared first on CoinGape.