Ethereum Exchange Netflows Highest Since March: Can ETH Survive This Selloff?

On-chain data shows that the Ethereum exchange net flows have been highly positive recently, a sign that selling may be taking place in the market.

Ethereum Exchange Netflows Have Seen A Spike Recently

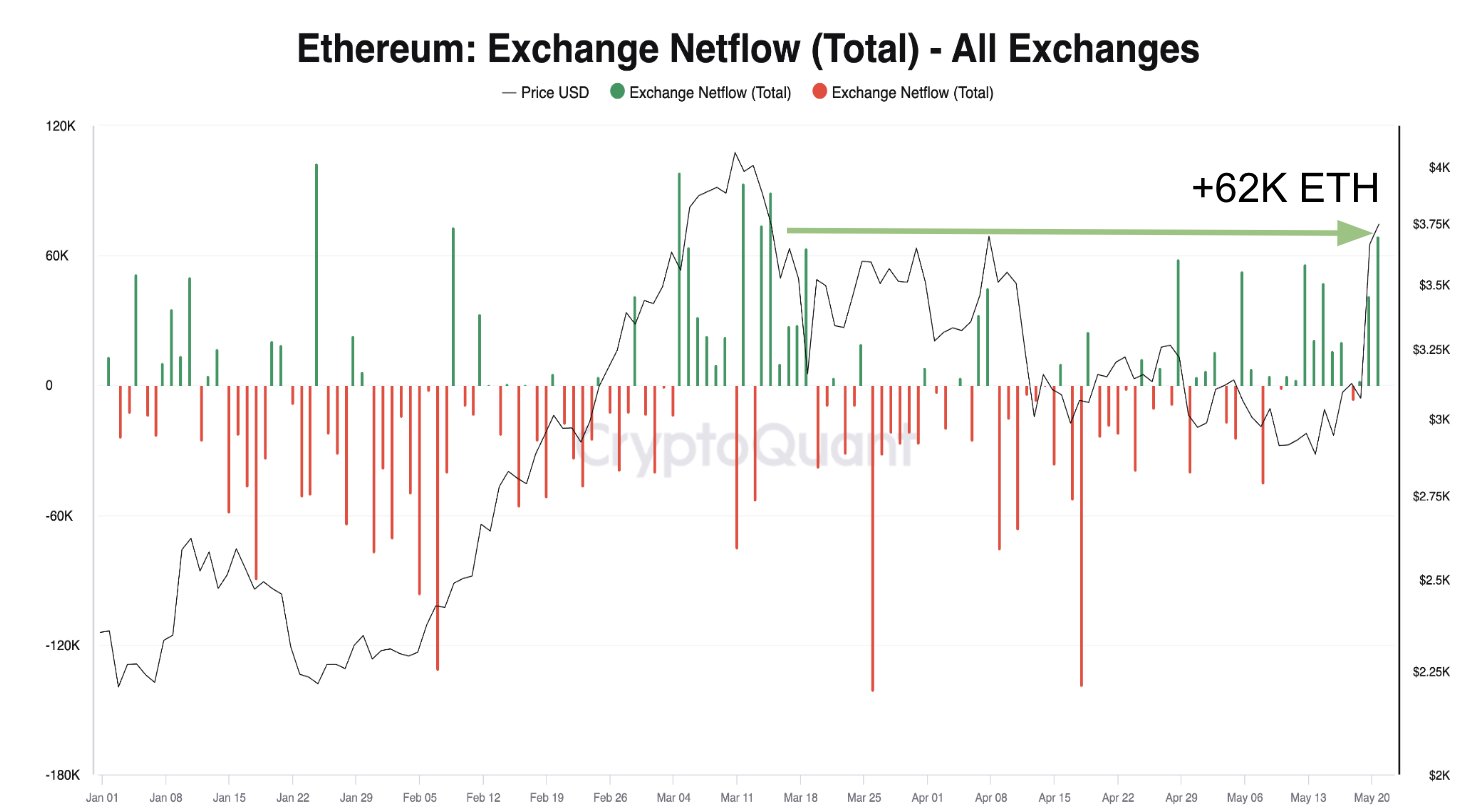

In a new post on X, CryptoQuant head of research Julio Moreno discussed the latest trend in Ethereum’s exchange netflow. The “exchange netflow” here refers to an on-chain metric that keeps track of the net amount of ETH moving into or out of the wallets of all centralized exchanges.

When this metric’s value is positive, it means that these platforms are receiving a net number of coins right now. As one of the main reasons holders might deposit coins to exchanges is for selling-related purposes, this trend can potentially bearish consequences for the asset’s price.

On the other hand, the indicator’s negative reading implies that exchange-associated wallets are observing net withdrawals currently. Investors may be moving their coins away from the custody of these central entities for long-term holding, so such a trend may prove to be bullish for the cryptocurrency.

Now, here is a chart that shows the trend in the Ethereum exchange netflow over the last few months:

The above graph shows that the Ethereum exchange netflow has registered some large positive spikes recently. These net deposits have been of a scale only observed in March. According to Moreno, these deposits have mostly been headed towards Binance and Bybit.

As mentioned before, net exchange inflows can indicate that selling is taking place in the market, although this doesn’t necessarily have to be the case. Sometimes, large deposits use one of the other services these platforms provide, like derivatives contracts.

Whatever the case, though, volatility does tend to rise following large deposits. The chart shows that the rally top back in March saw the indicator assume high values as investors participated in profit-taking.

Recently, Ethereum has observed a sharp surge, fueled by positive news surrounding the spot exchange-traded funds (ETFs). Given this rally, it’s possible that profit-taking may once again be the goal behind the positive net flows.

So far, though, ETH has managed to stave off this potential selloff, as its price has remained relatively high. It’s uncertain, however, how long demand can continue to absorb the possible selling pressure if deposits continue to flow into these platforms in the coming days.

ETH Price

Ethereum started a move up during the past day as its price breached the $3,950 mark. The rise only lasted briefly, though, as the asset returned below the $3,800 level.