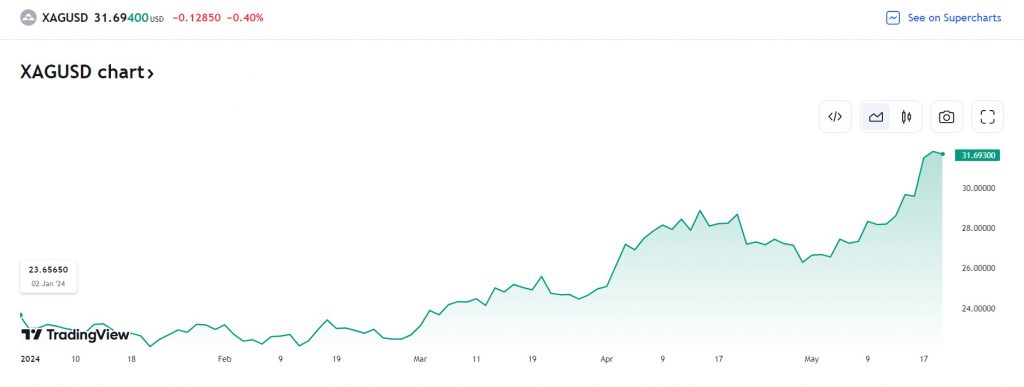

Commodity Market: Silver up 35%, Copper Surges 28%, Gold Rises 18%

The commodity market is the talk of the town as it outperformed the global stock market by a large margin. Commodities like silver, copper, and gold delivered stellar returns this year leaving the stock market behind.

Silver prices climbed above the $31 mark this week hitting new all-time highs. Also, copper breached the $10,000 threshold and is attracting heavy bullish sentiments due to global demand for the metal. In addition, gold prices are printing new highs every month and are now looking to reach the $2,500 price target.

Also Read: Silver Outperforms Gold in the Commodity Markets, Rises 35% YTD

Gold has spiked 17.54% year-to-date and fell third in line with silver and copper’s dramatic rise in the charts in 2024. The commodity market is attracting bullish sentiments due to the growing conflicts and geopolitical tensions across the world.

The Rise of Silver, Copper, & Gold in the Commodity Market

Institutional investors are taking an entry position in commodities and placing bets on gold, copper, and silver. All these three metals are in heavy demand by both industries and retail investors. Copper and silver are industrial metals and are filling in the gap in the manufacturing sector.

Also Read: After ‘Rigorous Analysis’, Expert Says Gold Prices Will Reach $27,000

On the other hand, gold is a safe haven and investors are flocking towards it in fear of a stock market crash. The growing tensions in the Middle East between Iran, Israel, and Palestine are a cause of concern among institutional funds. Additionally, the unending war between Russia and Ukraine is making the stock market remain on a slippery slope.

Also Read: Morgan Stanley Hikes S&P 500 Target By 20%

The stock market has risen in single digits this year compared to the broader commodity market. The Nasdaq Composite has risen only 5.5% YTD while India’s Sensex has moved ahead only 2.2%. Therefore, the developments indicate that the commodity market is stronger than the stock market and gold, silver, and copper could surge further this year.