Spot Ethereum ETFs Anticipated to Launch by July 4, Analysts Discuss Potential Inflows

The US Securities and Exchange Commission (SEC) is poised to approve several exchange-traded funds (ETFs) that will track the spot price of Ethereum (ETH), reportedly by July 4. This advancement follows final discussions with leading asset managers such as BlackRock and Grayscale Investments.

The introduction of these funds marks a significant milestone in the maturation of crypto markets and their adoption by mainstream investors. While initial reactions and the long-term performance of these ETFs remain speculative, the strategic initiatives by top asset managers suggest a strong belief in Ethereum’s potential.

Analysts Discuss Potential Inflows For Spot Ethereum ETFs

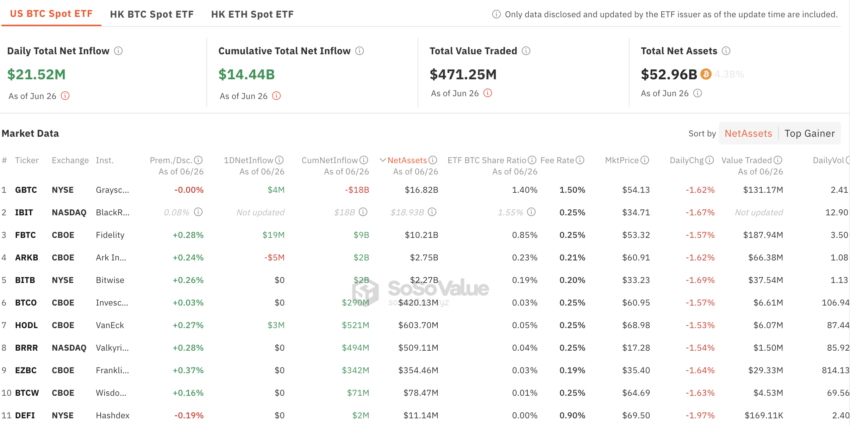

Asset managers are looking to build on the success of January’s spot Bitcoin ETFs, which attracted $14 billion in inflows. Particularly, Grayscale aims to transform an existing trust into a spot Ethereum ETF. This reflects a strategic move to broaden crypto investment options.

Senior ETF analyst Eric Balchunas suggests the Ethereum-based funds might launch as soon as July 2. Whereas according to a Reuters report, the SEC might approve spot Ethereum ETFs by July 4.

Read more: How to Invest in Ethereum ETFs?

Although discussions are ongoing, sources reveal that the remaining hurdles are merely minor adjustments to the offering documents, which are now nearing final approval. The anticipation around how the market will respond to these new ETFs is high. The debut of similar Bitcoin (BTC) products earlier this year saw assets surge to nearly $52.96 billion by June 26, as per SoSoValue data.

However, some analysts are cautious about Ethereum’s potential for similar success. James Butterfill, head of research at Coinshares, notes significant differences in market size and volume compared to Bitcoin. Moreover, Bryan Armour also doubts Ethereum ETFs will generate the same level of excitement.

“With Bitcoin, there had been pent-up demand for a decade and investor interest was off the charts. This just isn’t going to command the same excitement,” Armour said.

Conversely, optimism persists among other experts. Matt Hougan, chief investment officer at Bitwise, is upbeat about the prospects. His predictions are supported by a thorough analysis of market capitalizations and a review of international ETF markets.

“Ethereum ETPs (exchange-traded products) will attract $15 billion in net flows in their first 18 months on the market,” Hougan stated.

Read more: Ethereum ETF Explained: What It Is and How It Works

Once the SEC approves the registration statements of these funds, trading could begin within 24 hours. This is due to prior rule changes approved for major exchanges such as the New York Stock Exchange, Nasdaq, and Cboe.

The post Spot Ethereum ETFs Anticipated to Launch by July 4, Analysts Discuss Potential Inflows appeared first on BeInCrypto.