Lawmakers Pressure SEC to Approve Spot Ethereum ETFs

A group of bipartisan lawmakers is urging the US Securities and Exchange Commission (SEC) to approve spot Ethereum exchange-traded funds (ETFs).

House Majority Whip Tom Emmer, along with Representatives French Hill, Josh Gottheimer, Mike Flood, and Wiley Nickel, leads this appeal.

Lawmakers Push for Ethereum ETF Approval

The lawmakers urge the SEC to apply the same principles used when approving spot Bitcoin ETFs earlier this year. In a letter to SEC Chair Gary Gensler, they emphasized that by green-lighting a BTC-based instrument, the regulator set a precedent that should extend to Ethereum.

The SEC faces a deadline to decide on the VanEck Ethereum ETF, with other applications from BlackRock and Fidelity pending. Lawmakers emphasized the importance of maintaining investor protection while embracing modern financial markets. They argued that the same legal considerations for Bitcoin should apply to Ethereum, ensuring a consistent regulatory framework.

“Approving Bitcoin ETPs demonstrates the Commission’s fidelity to its mission to protect investors as well as the need to embrace the modern financial market. These approvals will set a strong foundation, ensuring investor protection remains paramount,” the letter stated.

Read more: Ethereum ETF Explained: What It Is and How It Works

The approval of spot Bitcoin ETFs has brought billions of dollars into the market, which is why lawmakers believe Ethereum ETFs should be treated similarly. The letter also mentioned correlation analyses between spot Ethereum and Ethereum futures, which align with the methodology used for Bitcoin.

Bloomberg ETF analyst Eric Balchunas commented on the broader implications for the ETF industry.

“It’s pretty surreal and fascinating to see ETFs get sucked into mainstream politics and an election year narrative. Wouldn’t be surprised if they pounce on SEC vulnerability and file all kinds of coins (kinda like they have in Europe) to test the limits,” he said.

Several asset management firms, including BlackRock, Grayscale, and Bitwise, have recently amended their spot Ethereum ETF filings to address SEC concerns. These amendments focused on excluding staking provisions, reflecting the SEC’s stance against staking in these ETFs.

Read more: How to Invest in Ethereum ETFs?

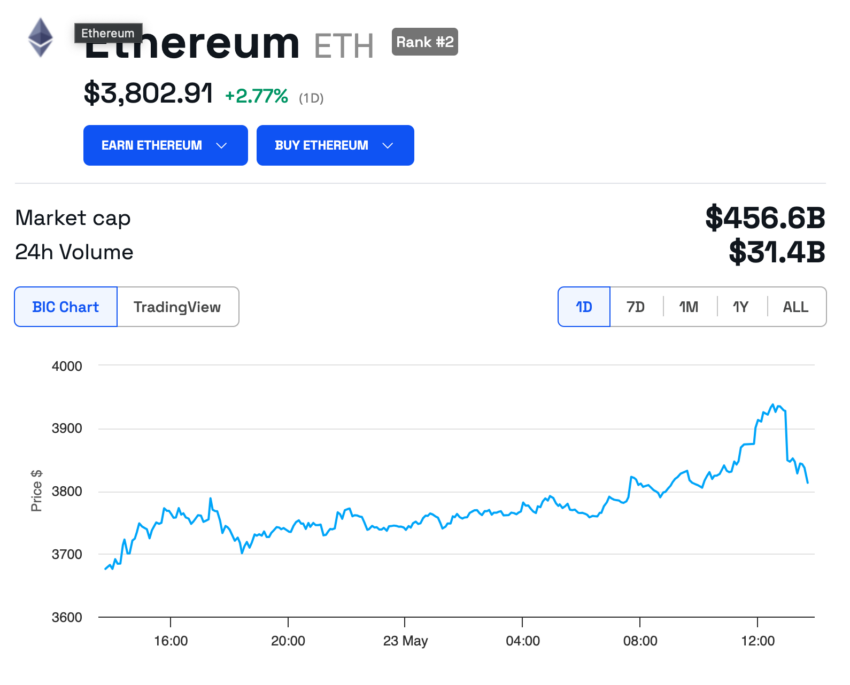

The approval of these ETFs is viewed as a bullish sentiment for the broader crypto market. Over the past 24 hours, ETH value has surged nearly 7%, approaching the $4,000 mark. Analysts believe that the granting spot Ethereum ETFs could drive the asset to new heights in the coming weeks.

The post Lawmakers Pressure SEC to Approve Spot Ethereum ETFs appeared first on BeInCrypto.