ETH at $5,000 Still on the Menu for 2024: Analyst

TL;DR

- Despite a recent price decline, analysts expect Ethereum to reach $5,000 by the end of 2024, driven by strong support at $3,500.

- Key metrics like a low RSI and increased self-custody movements suggest a potential rally for ETH.

New ATH Incoming?

Ethereum (ETH), just like many other leading cryptocurrencies, witnessed a severe correction at the start of June, which interrupted its bullish path. Currently, it trades at a little over $3,500 (per CoinGecko’s data), representing a 7% decline on a two-week scale.

Nonetheless, some industry participants remain optimistic about its future, speculating that a new all-time high price could be reached before the end of 2024. One example is the X user Jelle, who claimed that ETH has “successfully turned” the $3.5K mark into support. Based on this, the analyst expects a rally toward the coveted level of $5,000 sometime this year.

$ETH successfully turned $3,500 into support!

Very few people are ready for this one to make new all-time highs, but $5,000 ETH is very much on the menu this year.

Let’s roll. pic.twitter.com/k438SvCX2o

— Jelle (@CryptoJelleNL) June 17, 2024

Ali Martinez chipped in, too, claiming that whales have purchased over 700,000 ETH in the last three weeks, equaling a staggering $2.48 billion (at current rates). Such a move reduces the available supply of Ethereum on exchanges and could lead to a price rally (assuming demand stays the same or rises).

Another analyst who recently predicted a bright future for the second-largest cryptocurrency in terms of market capitalization is Wolf. The X user argued that it has been in a bullish mode since the beginning of the year. They forecasted enhanced volatility in the following months and an eventual bull run to as high as $5,000 at the end of Q3 2024.

What are Indicators Signaling?

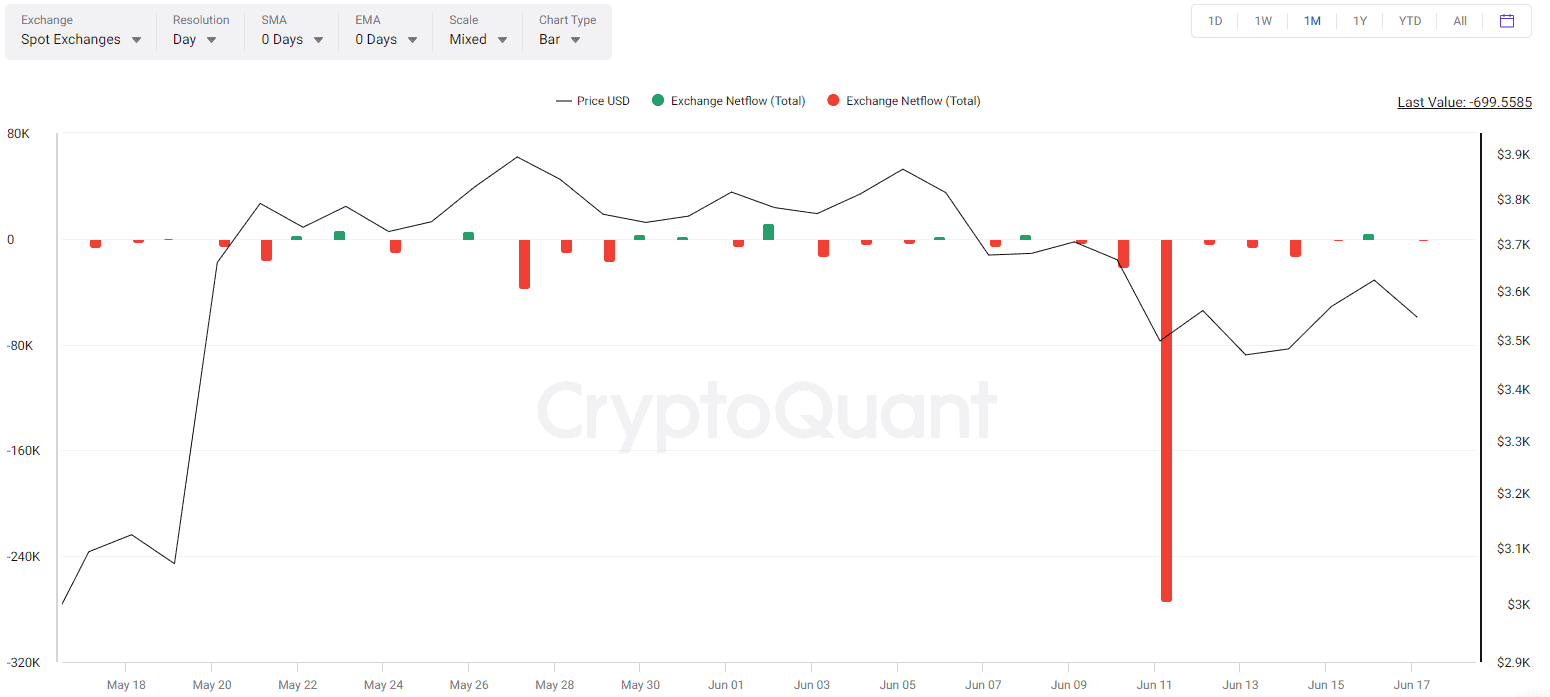

Important on-chain metrics, such as the Relative Strength Index (RSI) and ETH’s exchange netflow, also hint that the asset’s valuation could take off soon.

The RSI, a technical analysis tool that measures the change and speed of price movements, has not dropped below a ratio of 70 since May 23. Anything above that level signals that ETH is overbought and could be headed for correction.

For their part, Ethereum exchange inflows have significantly surpassed inflows in the past month (during most days). The shift from centralized entities toward self-custody methods is viewed as bullish since it decreases the immediate selling pressure.

The post ETH at $5,000 Still on the Menu for 2024: Analyst appeared first on CryptoPotato.