Currency Today: Indian Rupee Dips Significantly Against the US Dollar

In the latest currency update today, the Indian rupee has fallen significantly against the US dollar on Thursday’s opening bell. The INR lost ground against a firm USD while the Fed rate-cut bets capped the upside trajectory.

The Indian rupee had regained its lost ground early this week and surged to 83.43 on Wednesday. However, the US dollar rebounded in price making the Indian rupee fall to a new monthly low of 83.63 today.

Also Read: What’s Happening Between the U.S. Dollar & Petrodollar?

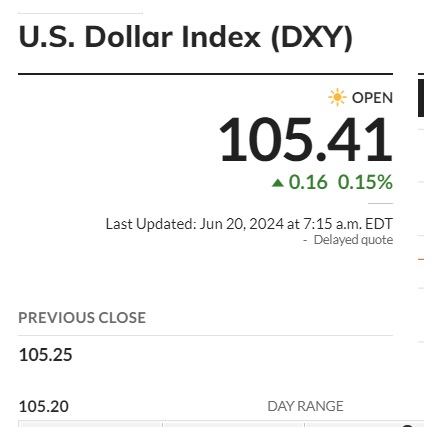

The DXY index, which tracks the performance of the US dollar, shows the currency 105.41 mark in the charts. The USD is up by 0.16 points with a surge of 0.15%. Despite threats of de-dollarization, leading Asian currencies have been unable to uproot or challenge the US dollar in the forex markets.

Also Read: U.S. National Debt Reaches All-Time High of $34.75 Trillion

22 out of 23 leading Asian currencies, including the INR, have dipped against the USD this month. The development indicates that the US dollar is gaining strength while the Indian rupee and other local currencies are losing balance.

Currency: Why is the Indian Rupee (INR) Falling Against the US Dollar (USD)?

The Indian economy has just come out of the election results with Prime Minister Narendra Modi receiving a fractured mandate. The move is making Foreign Institutional Investors (FII) remain cautious while entering the Indian markets. While some suggest that the bull market is over, others claim the next five years belong to India.

Also Read: ASEAN: Trade With China Hits $300 Billion, Increase 8.5% in 2024

Moreover, investors are waiting for further economic developments before taking an entry position. This is helping the US dollar gather steam while the Indian rupee is caught in the crosshairs.

A bullish USD could reach a high of 83.72 against the INR if it holds on to the positive momentum. Therefore, the Indian rupee is at risk of dipping further and currency investors are opening positions with the US dollar.