Crypto Research Firm Identifies Why The Bitcoin Price Could Crash To $45,000

10x Research, a digital asset research platform for traders and institutions, has unveiled a foreboding forecast for the price of Bitcoin (BTC). Highlighting current market conditions and Bitcoin’s recent price dynamics, the research firm projects a massive price crash to $45,000 soon.

Bitcoin $45,000 Price Crash Incoming

10x Research has released a report outlining several market factors, which, when combined, paint a picture of a potential price decline to new lows for Bitcoin. While the broader crypto market undergoes a period of correction and volatility, 10x Research believes that Bitcoin could fall as low as $45,000 this cycle.

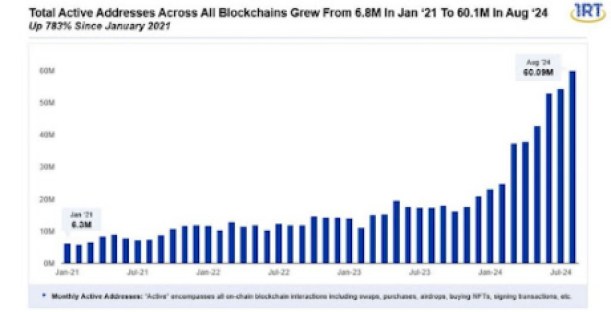

The reason for this prediction has been attributed to recent changes in Bitcoin’s active addresses. Markus Thielen, the Head of Research at 10x Research has laid out reasons for this pessimistic BTC prediction. Thielen mentioned that after Bitcoin addresses peaked in November 2023, they witnessed a sharp decline later in the First Quarter (Q1) of 2024.

According to Messari’s reports, on November 20, 2023, Bitcoin’s active address account rose above 983,000, even reaching 1.2 million at some point. The network remained steady within this range until April. However, as of September 2, 2024, active addresses have plummeted drastically to 596,940.

This drop in Bitcoin addresses indicated a reduction in network activity and a possible decrease in interest and demand among investors. Furthermore, Thielen disclosed that short term holders had begun selling their BTC in April, while long term holders took their profits, suggesting that the market had reached its cycle top.

In addition to this, the price of Bitcoin fell from its all time high above $73,000 in March to its current level of $55,246, according to CoinMarketCap. This price decline aligns with the decrease in active addresses and the broader market volatility.

10x Research also reported that outflows in Spot Bitcoin Exchange Traded Funds (ETFs) have contributed to BTC’s downward pressure and led to their pessimistic price projection. In the last eight days, Spot Bitcoin ETFs recorded a whopping $1.2 billion in outflows from the 11 listed US Bitcoin ETFs. This massive liquidation is currently the longest run of outflows since the launch of Bitcoin ETFs on January 10, 2024.

Moreover, the current state of the United States (US) economy also paints a possible bearish picture for Bitcoin. The weak US economy and the ongoing futures liquidations are among the many factors that 10x Research believes could push the price of Bitcoin down to $45,000.

BTC Faces Toughest Month In September

In an X (formerly Twitter) post, Dan Tapiero, the founder and Chief Executive Officer (CEO) of 10T Holdings, addressed the current challenges in the crypto market. Tapiero noted that September has historically been difficult for Bitcoin, often marked by poor performance or increased selling pressures.

He disclosed that Bitcoin and Ethereum (ETH) have been stuck in a “painful consolidation” period since March. Despite Bitcoin’s underperformance this September, Tapiero remains confident that the market is gearing up for a major bullish trend, advising investors to HODL their assets.