BRICS Bank to Fund Projects in Local Currency, Ditching US Dollar

In a rather important development for the alliance, the BRICS New Development Bank is seeking to fund projects in local currency. Moreover, the development is ultimately a way to eventually ditch the US Dollar for unilateral transactions. Subsequently influencing the bloc’s overall de-dollarization initiatives.

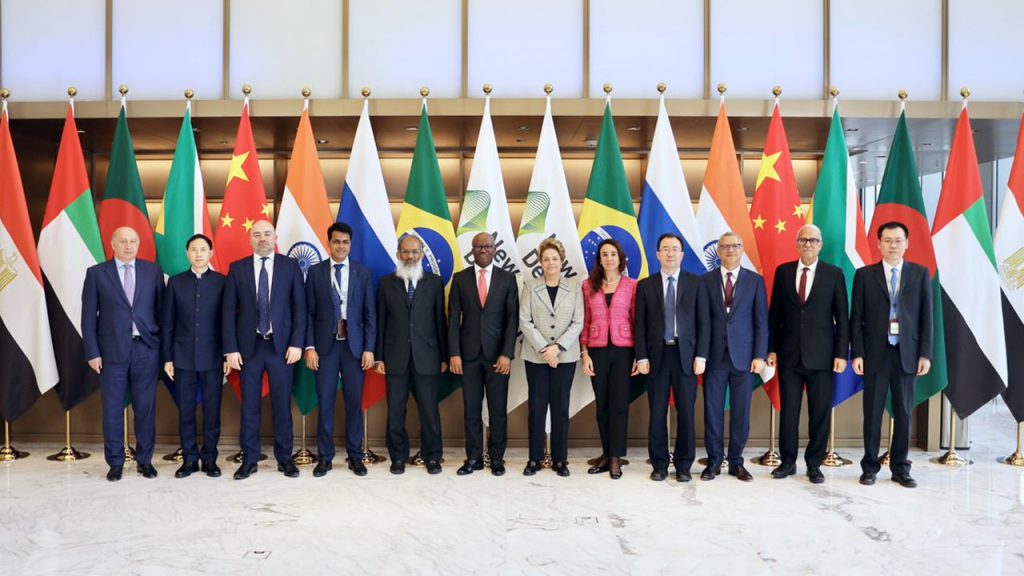

Speaking to CGTN Africa, New Development Bank Vice President Vladimir Kazbekov spoke on the transition. Ultimately, he noted de-dollarization as “a process,” and something that cannot take place overnight. Thereafter, he noted how the bank is doing its part in continuing that process through its funding practices.

Also Read: BRICS: China’s Economy Grew 5% in 2023

BRICS Bank Funding Will Primarily Take Place in Local Currencies

For much of the last year, the BRICS alliance growth was a crucial geopolitical development. Indeed, the bloc increased its membership, growing from a five-member collective to featuring ten represented countries. Subsequently, its de-dollarization focus expanded through the introduction of even more members.

With more participants, the strategy to lessen international reliance on the dollar took a massive step forward in another key area. Specifically, the BRICS New Development Bank announced it will fund projects in local currency, ditching its increased usage of the US Dollar.

Also Read: BRICS Countries India & Russia Speak: Here’s What They Discussed

The bank’s vice president and chief operating officer, Vladimir Kazbekov discussed the new funding strategy in a sit-down interview with CGTN Africa. There, he called de-dollarization a “process,” and said that “the speed of this process depends on various conditions, countries, markets, etc.”

Additionally, he noted that currencies like China’s yuan are much cheaper than the dollar presenting an “opportunity,” for the bank to embrace. Moreover, he identified the opportunity to use the yuan to fund projects outside of China. Ultimately, its efforts could present lasting effects on the promotion of the alliance’s local currencies.

Conversely, Kazbekov discussed the opportunity for currency swaps within the development bank. The BRICS alliance has agreed to a lot of currency swaps over the past year, between different countries within the alliance. Through the New Development Bank, those kinds of deals could have yet another accessible avenue.