Bitcoin Takes Control In Market Meltdown, Dominance Climbs To 9-Week Peak

The cryptocurrency market is currently experiencing significant turbulence, prompting a shift in investor behavior towards Bitcoin, which has traditionally been seen as the safest asset within the digital currency ecosystem.

This shift has resulted in Bitcoin’s dominance climbing to a nine-week high of 57%. Amidst the market chaos, Bitcoin has emerged as a beacon of relative stability, while altcoins are bearing the brunt of the sell-off.

In times of market uncertainty, investors often gravitate towards what they perceive as safer assets. This behavior is evident in the recent crypto market dynamics, where Bitcoin has become the preferred choice for investors looking to weather the storm.

The broader market sell-off, which saw a staggering $110 billion in market value vanish in just one week, has particularly impacted altcoins. Projects such as Akash Network, Floki, and Chiliz have experienced significant declines, each plummeting over 30%.

The Appeal Of Bitcoin

Bitcoin’s appeal lies in its established track record and perceived stability compared to newer, more volatile altcoins. This perception has driven many investors to seek refuge in Bitcoin, while altcoins are left exposed to harsh market conditions. This shift in preference underscores a broader belief that Bitcoin offers a safer haven during periods of market distress.

Long-Term Perspective On Bitcoin’s Dominance

Despite Bitcoin’s current dominance, some analysts advise caution. Jelle, a seasoned crypto trader, suggests that Bitcoin’s dominance might not be sustainable in the long run.

#Bitcoin dominance continues to lose steam as price consolidates right below all-time highs.

Almost as if #Altcoins will outperform as soon as BTC breaks out.

Almost. pic.twitter.com/tjVOaUHskm

— Jelle (@CryptoJelleNL) June 17, 2024

He argues that altcoins, with their innovative features and potential for significant growth, could reclaim their lost ground once Bitcoin surpasses its previous all-time high of $74,000. This perspective highlights the cyclical nature of the crypto market, where different assets can outperform at different times.

Market Sentiment And Future Prospects

The broader market’s current downturn has led to a bearish sentiment, with Bitcoin struggling to maintain its footing within a crucial support zone around $64,500. The prevailing sentiment is one of caution, as the market grapples with uncertainty.

However, there are glimmers of hope on the horizon. Interestingly, while the crypto market has been experiencing a decline, tech stocks have been performing well, marking their seventh consecutive day of gains. This divergence suggests that the current downturn might be specific to the crypto market rather than indicative of a broader economic malaise.

Volatility And Potential Reversals

The notorious volatility of the crypto market means that swift reversals are always a possibility. Historically, digital assets have been prone to dramatic swings, and what goes down can just as quickly go back up.

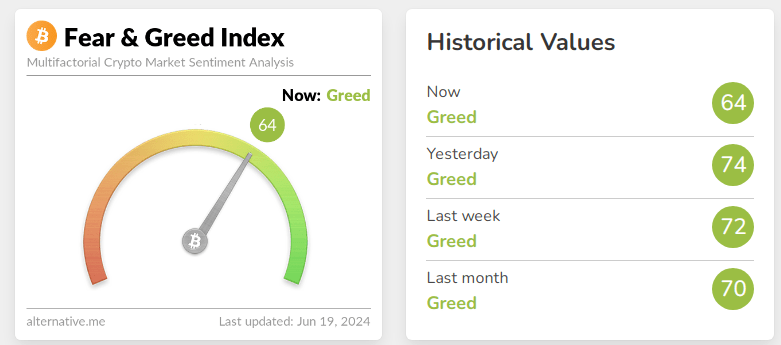

This inherent volatility is both a risk and an opportunity for investors. The recent uptick in the Fear & Greed Index to 64 indicates that despite the sell-off, some investors remain optimistic, exhibiting a degree of irrational exuberance.

Featured image from Photlurg, chart from TradingView