Solana (SOL) Heads for Key Moving Average as Buying Pressure Declines

Solana (SOL) broke out of an ascending channel in a downtrend on May 20, and its value has since declined by 13%.

As the altcoin’s price aims to cross below its 20-day Exponential Moving Average (EMA), SOL is put at risk of further decline as selling pressure continues to increase.

Solana Bears Are Having a Field Day

The double-digit decline in SOL’s price in the past three days has pushed it toward its 20-day EMA. Poised to cross below the key average, this would signal a surge in SOL sell-offs among market participants.

An asset’s 20-day EMA is a short-term moving average that reacts quickly to price changes. It reflects the average closing price of an asset over the past 20 days.

When an asset falls below this moving average, it is a bearish signal because it means that the asset’s current price is less than its average price of the past 20 days. It is regarded as a shift toward coin distribution.

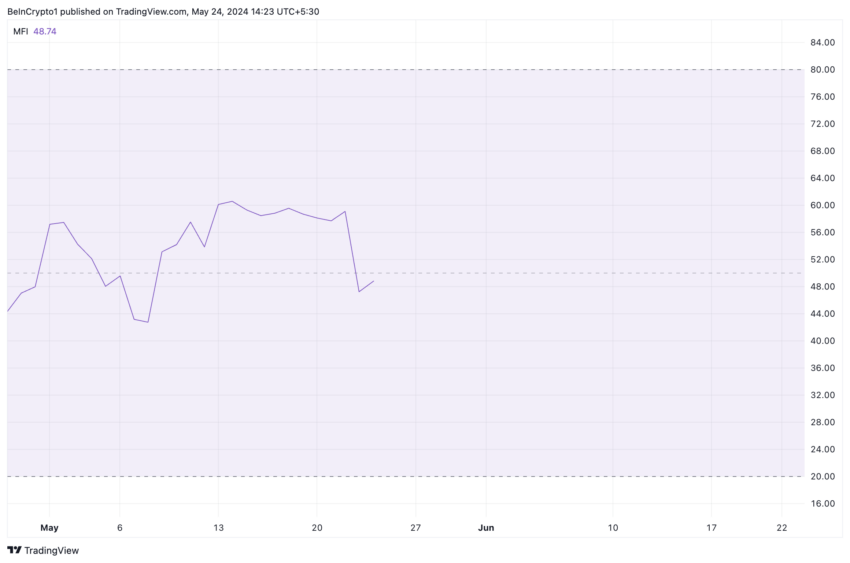

The decline in SOL’s Money Flow Index (MFI) confirmed the surge in bearish influence. This indicator measures the buying and selling pressure behind SOL’s price movement.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

At press time, SOL’s MFI rested under its 50-neutral line at 48.84, suggesting that selling activity outpaced buying momentum among market participants.

SOL Price Prediction: Long Traders Remain Steadfast

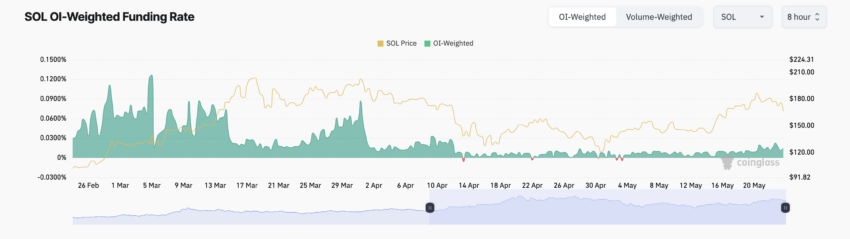

The decline in SOL’s price in the past few days has led to a surge in long liquidations in the altcoin’s derivatives market. Between May 20 and 23, over-leveraged SOL traders lost $19 million.

Liquidations happen when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, forcing traders who have open positions in favor of a price rally to exit their positions.

Interestingly, despite this, SOL futures traders continue to demand more long positions. Its funding rates have remained positive, at 0.014% at press time.

If this trend is maintained and the bulls regain control of the coin’s spot market, SOL’s price might rally to $169.94.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

However, if selling pressure continued to mount, SOL’s next price level might be $151.95.

The post Solana (SOL) Heads for Key Moving Average as Buying Pressure Declines appeared first on BeInCrypto.