3 US Economic Events That Could Impact Crypto Market This Week

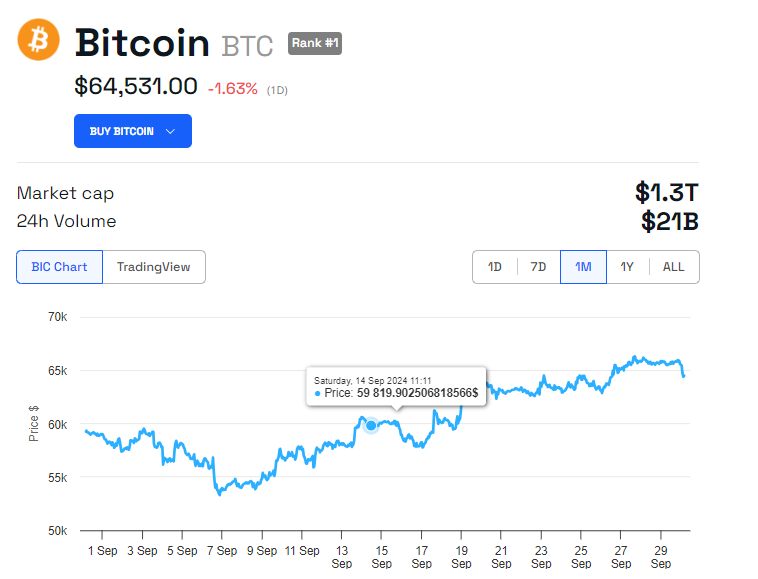

Crypto markets have several US economic events to look forward to this week after a subdued weekend in which Bitcoin’s (BTC) price failed to breach the $65,000 threshold.

For the most part, all eyes will be on the US labor market as maximum employment falls under the Federal Reserve’s list of mandates.

September’s ISM Manufacturing PMI

September’s ISM Manufacturing PMI will be crucial in gauging economic activity, as the data reflects the health of the manufacturing sectors. The consensus looks for the ISM manufacturing survey to print 47.3 in September, which would signify a rather small change compared to the 47.2 recorded in August.

The September data is due on Tuesday, October 1. The latest 10X Research anticipates anxiety leading up to tomorrow’s release and the ones to follow.

“While most attention has been on US employment data, the ISM Manufacturing Index triggered a 10% market correction during the first week of each of the last three months. Employment data played a crucial role in shaping market sentiment. Weak employment figures fueled recession fears, increasing expectations for Fed rate cuts, while more robust employment data reassured investors that the economy was more resilient than the ISM Manufacturing Index suggested,” the researchers said.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

A higher-than-expected PMI, relative to the previous reading of 47.2, indicates a strong economy. If this happens, it could lead to increased investor confidence in traditional markets, potentially prompting them to allocate more capital to riskier assets like cryptocurrencies as a hedge against inflation or market volatility.

ISM Services PMI

Like the manufacturing data, the ISM Services PMI also measures economic activity and is a reflection of the services sector’s health. According to S&P Global’s flash PMI report for September, optimism about service output in the year ahead deteriorated sharply. Specifically, the survey’s future output index fell to its lowest since October 2022.

This dwindling confidence came amid concerns over the outlook for the economy and demand amid uncertainty regarding the Presidential Election.

Expectations are for the Services PMI to rise a touch to 51.7 in September from 51.5 in August. The data is due for release on Thursday, October 3.

If the data comes in higher than expected, it would suggest a strong economy, likely increasing investor confidence in traditional markets. In the same way, investors may be more open to allocating more capital to riskier assets like Bitcoin.

Nonfarm Payrolls and Unemployment Rate

Nonfarm Payrolls (NFP) data is a crucial indicator of labor market health, offering insight into job creation and employment levels. A strong NFP report, reflecting robust job growth, can stimulate consumer spending, drive economic expansion, and increase demand for digital assets.

Conversely, a weaker-than-expected NFP report may spark concerns about economic stability, pushing investors toward alternative assets like cryptocurrencies. The Unemployment Rate, another vital economic measure, reflects the strength of the labor market. A declining unemployment rate often signals a stronger economy, boosting consumer confidence and potentially driving crypto prices higher as individuals diversify their portfolios.

The consensus forecast for September expects 145,000 new nonfarm payrolls, up from 142,000 in August, while the unemployment rate is projected to remain steady at 4.2%.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Capital Economics notes that while job growth remains positive, it has slowed compared to previous years, with hiring expectations also declining. Consumer confidence in job security is weakening, as indicated by the Conference Board’s survey, which warns of the unemployment rate potentially rising to 5% later this year.

With the labor market cooling, Capital Economics suggests that persistent underperformance in payroll data could prompt the Federal Reserve to consider an additional 50 basis point (bps) rate cut in November, following a similar cut in September.

Jerome Powell Speech

Markets are also bracing for Federal Reserve chair Jerome Powell’s speech on Monday, September 30. Powell is expected to elaborate on the Fed’s decision to cut its benchmark interest rate by half a percentage point and shed light on the considerations that will frame an expected series of interest rate cuts for the remainder of the year and into 2025.

As crypto markets brace for volatility induced by these US economic events, Bitcoin price remains below the $65,000 threshold. As of this writing, it is trading for $64,531, down 1.63% since Monday’s session opened.

The post 3 US Economic Events That Could Impact Crypto Market This Week appeared first on BeInCrypto.